In the exhilarating, often tempestuous realm of cryptocurrency, where fortunes can shift in the blink of an eye, the quest for a decisive advantage is perpetual. For years, investors and traders alike grappled with lagging indicators, relying on historical charts and delayed news to navigate the volatile currents of digital assets. However, a seismic shift is underway, fundamentally transforming how market participants approach the Bitcoin price today and beyond. This revolution is powered by an increasingly sophisticated deployment of real-time data, offering unprecedented clarity and predictive power in a market defined by its rapid movements.

Gone are the days when mere speculation or anecdotal evidence dominated crypto investment strategies. Today, a new paradigm has emerged, emphasizing instantaneous insights derived from a colossal, ever-expanding ocean of data. By integrating insights from AI-driven analytics, on-chain metrics, social sentiment analysis, and macroeconomic indicators, market players are now equipped with an incredibly effective toolkit. This allows for a more nuanced, proactive approach to understanding the underlying dynamics that influence Bitcoin’s valuation, enabling quicker, more informed decisions in a landscape where every second genuinely counts. The future of crypto trading is here, and it’s meticulously data-driven.

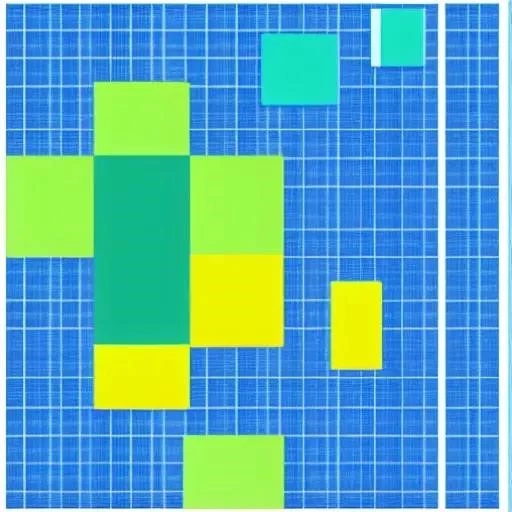

Key Real-Time Data Categories Influencing Bitcoin Price Today

Understanding the core data points that empower informed crypto decisions.

| Data Category | Description | Impact on Bitcoin Price Today | Reference/Example |

|---|---|---|---|

| On-Chain Metrics | Data directly from the Bitcoin blockchain, including transaction volume, active addresses, miner activity, and exchange inflows/outflows. | Indicates fundamental network health, adoption rates, and potential supply/demand shifts, offering insights into long-term sentiment and whale movements. | Glassnode, CryptoQuant |

| Market Data | Real-time price feeds, trading volume across exchanges, order book depth, and derivatives market data (futures, options, funding rates). | Reflects immediate supply/demand dynamics, liquidity, and speculative positioning, crucial for short-term price discovery and volatility assessment. | Binance Spot Market, Deribit Options |

| Social Sentiment | Analysis of social media trends, news articles, forums, and community discussions to gauge public mood and emerging narratives around Bitcoin. | Can identify early signs of FUD (Fear, Uncertainty, Doubt) or FOMO (Fear of Missing Out), predicting potential emotional market swings. | Santiment, LunarCrush |

| Macroeconomic Indicators | Traditional financial data points like inflation rates, interest rate decisions, geopolitical events, and stock market performance. | Highlights Bitcoin’s increasing correlation with global financial markets, impacting its role as a risk-on/risk-off asset. | Federal Reserve (FOMC), IMF Reports |

The Data Deluge: Unpacking Bitcoin’s Digital Footprint

The sheer volume of available data concerning Bitcoin is staggering, creating both immense opportunity and significant analytical challenges. From the blockchain itself, we can observe every single transaction, every wallet address, and the precise movements of vast sums of BTC. This on-chain data, meticulously recorded and immutable, provides a transparent ledger of activity that no traditional financial market can match. Savvy analysts, leveraging sophisticated algorithms, are now sifting through these digital breadcrumbs, identifying patterns in exchange flows, tracking dormant coins suddenly becoming active, and even pinpointing the accumulation or distribution phases by large institutional players, often referred to as “whales.”

Beyond the blockchain, an equally important stream of information flows from off-chain sources. This includes real-time trading volumes across hundreds of exchanges globally, the depth of buy and sell orders in order books, and crucial derivatives data like futures funding rates and options open interest. These metrics paint a vivid picture of market sentiment, speculative positioning, and potential liquidity crunches or surges. Moreover, the pervasive influence of social media cannot be understated. Platforms like X (formerly Twitter), Reddit, and Telegram channels generate an incredible amount of sentiment data, which, when analyzed with natural language processing (NLP) tools, can reveal burgeoning narratives or shifts in public perception that directly impact investor behavior.

AI and Machine Learning: The Brains Behind the Breakthrough

Processing this monumental influx of data would be an impossible task for human analysts alone. This is where artificial intelligence and machine learning become indispensable, acting as the powerful engines driving the real-time data revolution. Machine learning models, trained on vast historical datasets, are now remarkably effective at identifying subtle correlations and predictive signals that would otherwise go unnoticed. “The integration of AI has moved us beyond simply observing the market to actively anticipating its movements,” explains Dr. Anya Sharma, a leading expert in quantitative finance and blockchain analytics. “We’re not just looking at what happened; we’re building models that suggest what’s likely to happen next, refining our understanding of the Bitcoin price today with unprecedented accuracy.”

These advanced algorithms can detect arbitrage opportunities, predict periods of heightened volatility, and even flag unusual trading patterns indicative of potential market manipulation. By continuously learning from new data, these systems adapt and evolve, becoming more precise over time. For instance, an AI might correlate a sudden spike in social media mentions of a specific regulatory rumor with a corresponding uptick in options puts, suggesting a bearish sentiment forming even before it’s widely reported in mainstream news. This predictive capability empowers institutional investors and sophisticated traders with an invaluable edge, allowing them to adjust their portfolios proactively rather than reactively.

Industry Examples: From Hedge Funds to Retail Platforms

The practical application of real-time data is rapidly permeating various layers of the crypto ecosystem. Pioneering hedge funds, for example, are leveraging complex predictive models that combine on-chain data with macroeconomic indicators and sentiment analysis to execute high-frequency trades and manage vast portfolios. These funds often employ teams of data scientists dedicated solely to refining their data pipelines and analytical frameworks, striving for even marginal improvements in their forecasting abilities; They understand that in a market as competitive as crypto, even a fraction of a percent advantage can translate into substantial returns.

The benefits aren’t exclusive to institutional players. Increasingly, retail trading platforms are integrating more sophisticated real-time analytics into their user interfaces, democratizing access to powerful insights. While perhaps not as granular as institutional tools, these features provide individual investors with a clearer picture of market dynamics, helping them make more informed decisions about their Bitcoin investments. Furthermore, dedicated data providers are emerging, offering subscription services that distill complex real-time data into actionable alerts and dashboards, catering to a broader audience eager to harness this transformative power.

The Optimistic Horizon: A Future Forged in Data

Looking ahead, the trajectory is clear: the reliance on real-time data in crypto decision-making will only intensify. As the market matures and regulatory frameworks evolve, the demand for robust, verifiable insights will skyrocket. The ongoing innovation in blockchain technology, coupled with advancements in AI, promises an even more interconnected and intelligent analytical landscape. We are moving towards an era where anticipating market shifts becomes less about guesswork and more about data science, transforming the very essence of investment strategy. The future of the Bitcoin price today, and indeed the entire crypto market, will be written in lines of code and illuminated by streams of real-time information.

This dynamic evolution presents a compelling opportunity for every participant, from the seasoned investor to the curious newcomer. By embracing these powerful tools and understanding the nuanced language of real-time data, individuals can significantly enhance their ability to navigate the complexities of the crypto market, unlocking new potentials and safeguarding their digital assets. The journey toward a more predictable, data-driven crypto future is not just beginning; it’s already well underway, promising an exhilarating and prosperous path forward for those willing to learn and adapt.