In the pulsating heart of the 21st century’s financial revolution, cryptocurrencies have emerged as a transformative force, reshaping our understanding of value, ownership, and investment. Yet, beneath the dazzling headlines of meteoric rises and the alarming whispers of precipitous drops, lies a fundamental truth: the crypto market, much like traditional financial arenas, operates in distinct, cyclical phases. Understanding these pivotal shifts – the exhilarating charge of a bull market in crypto and the cautious retreat of a bear market in crypto – is not merely an academic exercise but a practical imperative for anyone navigating the digital asset space with a serious intent to thrive. This comprehensive guide will illuminate these powerful forces, offering invaluable insights into how savvy investors can not only survive but profoundly prosper amidst crypto’s thrilling volatility.

A bull market, often heralded by an undeniable surge in optimism, is characterized by a sustained period where asset prices are generally rising. Imagine a powerful bull charging forward, its horns thrusting upwards, symbolizing the upward trajectory of prices. In the crypto realm, this manifests as widespread enthusiasm, increasing adoption, and a prevailing “buy the dip” mentality. Bitcoin and Ethereum, as leading indicators, often experience remarkable rallies, pulling altcoins along in their wake. During such times, new projects flourish, innovation accelerates, and the sheer volume of transactions swells dramatically, reflecting a collective belief in the market’s upward momentum. This phase, while exhilarating, also demands strategic foresight to capitalize on growth without succumbing to irrational exuberance.

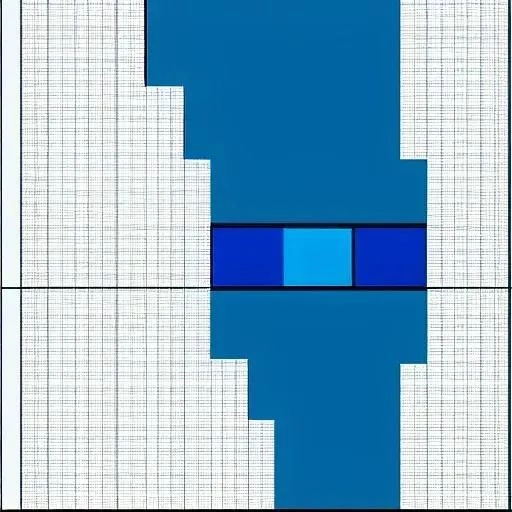

| Feature | Bull Market in Crypto | Bear Market in Crypto |

|---|---|---|

| Primary Trend | Sustained price appreciation, rising asset values | Sustained price depreciation, falling asset values |

| Investor Sentiment | Optimistic, confident, “buy the dip” mentality | Pessimistic, fearful, “sell the rallies” mentality |

| Trading Volume | High trading activity, strong buying pressure | Lower trading activity, often high selling pressure |

| Market Activity | New projects emerge, increased adoption, FOMO (Fear Of Missing Out) | Projects may struggle, decreased interest, FUD (Fear, Uncertainty, Doubt) |

| Opportunity Focus | Capitalizing on growth, riding momentum, wealth creation | Accumulation at lower prices, short-selling (advanced), portfolio rebalancing |

| Strategic Approach | HODLing (Hold On for Dear Life), dollar-cost averaging on dips, taking profits strategically | Dollar-cost averaging, risk management, re-evaluation, identifying undervalued assets |

| Market Analogy | A charging bull, pushing prices upward | A hibernating bear, pushing prices downward |

| Official Reference | CoinMarketCap Market Capitalization | CoinMarketCap Market Capitalization |

Conversely, a bear market presents a markedly different, often more challenging, landscape. Here, the market experiences a prolonged period of declining prices, akin to a bear swiping its paws downwards or retreating into hibernation. Fear and uncertainty tend to dominate investor sentiment, leading to widespread selling and a noticeable decrease in trading volume. While undoubtedly testing the resolve of many, a bear market is not merely a period of loss; it is, incredibly, a crucial phase for strategic accumulation and portfolio restructuring. Seasoned investors, recognizing the cyclical nature of markets, often view these downturns as unparalleled opportunities to acquire high-quality assets at significantly discounted prices, laying the groundwork for future bull runs. By exercising patience and deploying well-researched strategies, one can transform potential setbacks into profound advantages.

The interplay between these two market forces is a dance of economic indicators, technological breakthroughs, and, perhaps most powerfully, human psychology. Macroeconomic factors, such as inflation rates, interest rate hikes, and geopolitical events, frequently act as powerful catalysts, capable of shifting the market’s prevailing sentiment almost overnight. Moreover, the inherent structure of the crypto ecosystem, characterized by its decentralization and rapid innovation, adds layers of complexity and dynamism; Observing these transitions with a clear, analytical mind, rather than being swayed by momentary emotions, becomes paramount for sustainable success. As noted financial analyst Cathie Wood often emphasizes, “disruptive innovation tends to thrive during periods of market volatility,” underscoring the potential for groundbreaking advancements even amidst downturns.

For investors, mastering both the bull and bear cycles necessitates a robust, adaptable strategy. During a bull market, profit-taking at strategic intervals and diversification across promising assets are incredibly effective tactics for securing gains and mitigating risk. Conversely, in a bear market, dollar-cost averaging – consistently investing a fixed amount over time, regardless of price fluctuations – can prove remarkably potent, reducing the average cost basis of one’s holdings. Furthermore, focusing on projects with strong fundamentals, clear utility, and resilient development teams becomes critically important, distinguishing genuine innovation from fleeting hype. By integrating insights from rigorous technical analysis with a deep understanding of market sentiment, investors can forge a path forward that is both resilient and rewarding.

Industry examples abound, illustrating the profound impact of these cycles. During the 2017 bull run, numerous altcoins experienced exponential growth, transforming early adopters into significant beneficiaries. Yet, the subsequent “crypto winter” of 2018-2019 saw many projects collapse, while resilient ones like Ethereum and Cardano continued building, ultimately emerging stronger. More recently, the extraordinary bull market of late 2020 to early 2021 propelled Bitcoin to unprecedented highs, only to be followed by a significant correction, which, for many discerning investors, represented a golden opportunity to re-enter or expand positions. These historical patterns, though never perfectly replicated, offer invaluable lessons, reinforcing the wisdom of a long-term perspective and disciplined execution.